Adsense收款教程 Adsense 美国账号收款该如何填写税表

👨💻罗格 💠Google AdSense实操教程 ⏰7年前 (2019-02-08) 👁️14056 Views 💬4 comments我想 Adsense 美国账号运营的朋友大概都会遇到这个问题,我最近谈了一家国内专门做收款的公司,他们家可以代收我们 Adsense 美国账号的收入,这对于国内的小伙伴或许是一个福利,而且手续费只有1%,具体如何如何操作等我后面专门出教程给到大家。

因为经常注册美号并且也有多个英语网站在运作,所以这里就给大家介绍一下 Adsense 美国账号该如何填写W-8税表。

扩展阅读:

Adsense美号税务填写教程

首先第一点当然是你需要有一个美国的Adsense账号,否则没什么卵用啦!当然你还需要准备好一下信息

- 个人身份证x1

- 美国地址x1

- 美国能帮你收pin的人

以上就是你所需要的东西,都齐全了之后即可填写Adsense美号税务了!当然你可以可以先填写收pin可以之后在收。

你也许感兴趣:

新博客快速申请 Google AdSense 账号获批通过的技巧及答疑

Google Adsense 相关申请优化收款教程专题整理

网站免打理自动盈利的技巧分享 - 你好污啊案例篇

建立英文网站赚 Google Adsense 美元的技巧(长文)

第一步

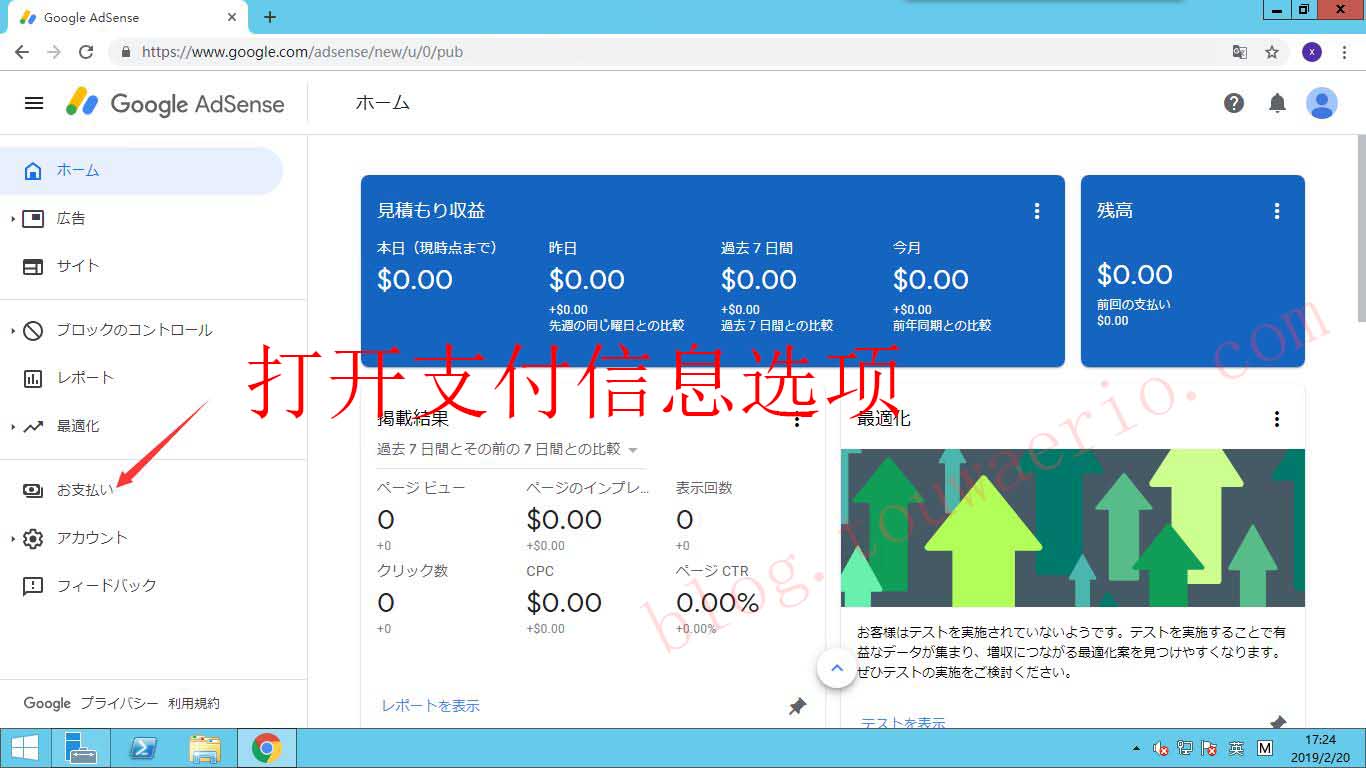

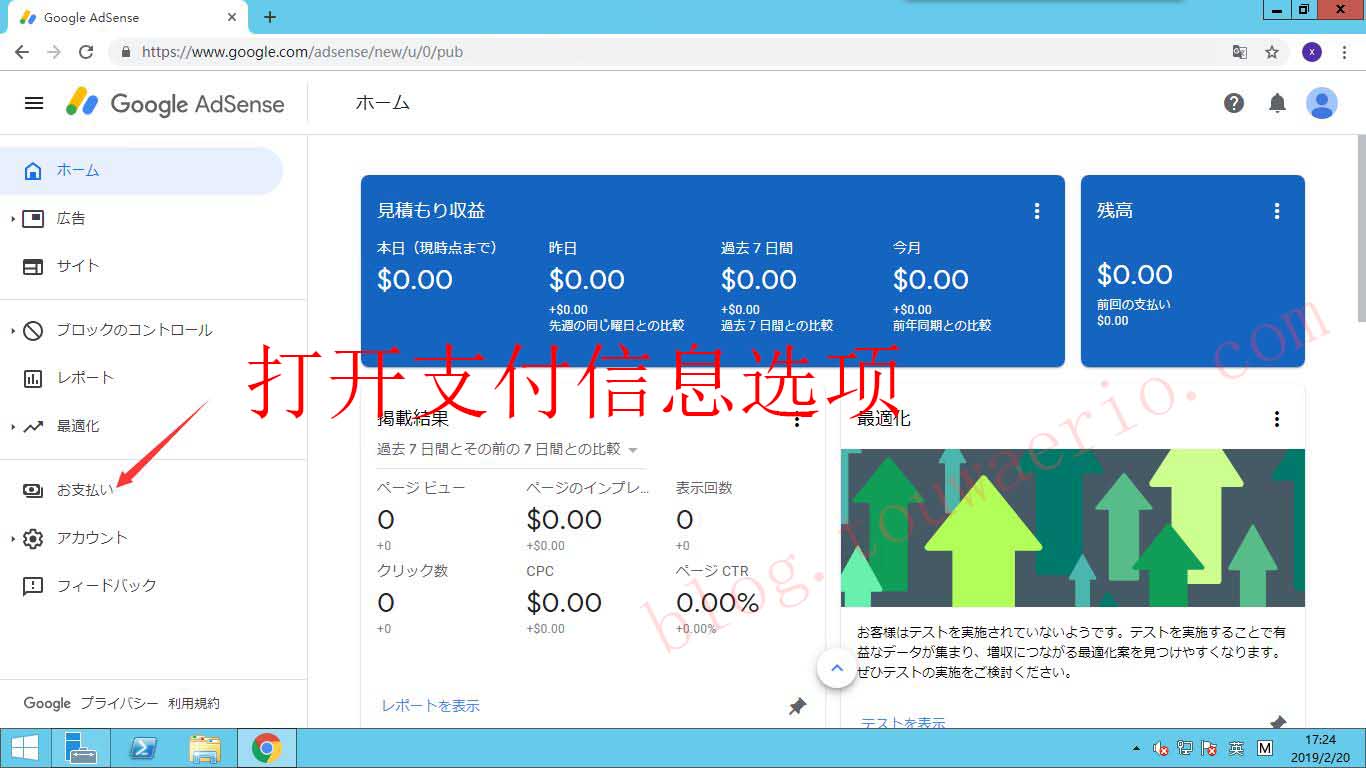

登录Adsese后台并且打开支付信息选项进行设置,本人系统是日文所以谷歌注册的账号基本都是跟随我系统的大体上税务填写都是那个流程大家看着来即可!!

接着看到设置地方那里有个用户信息显示接下来点击设定管理进到个人设置,当然个人设置里面就是你的注册用户信息了当然收pin修改地址的话也是从这里面进行修改的。

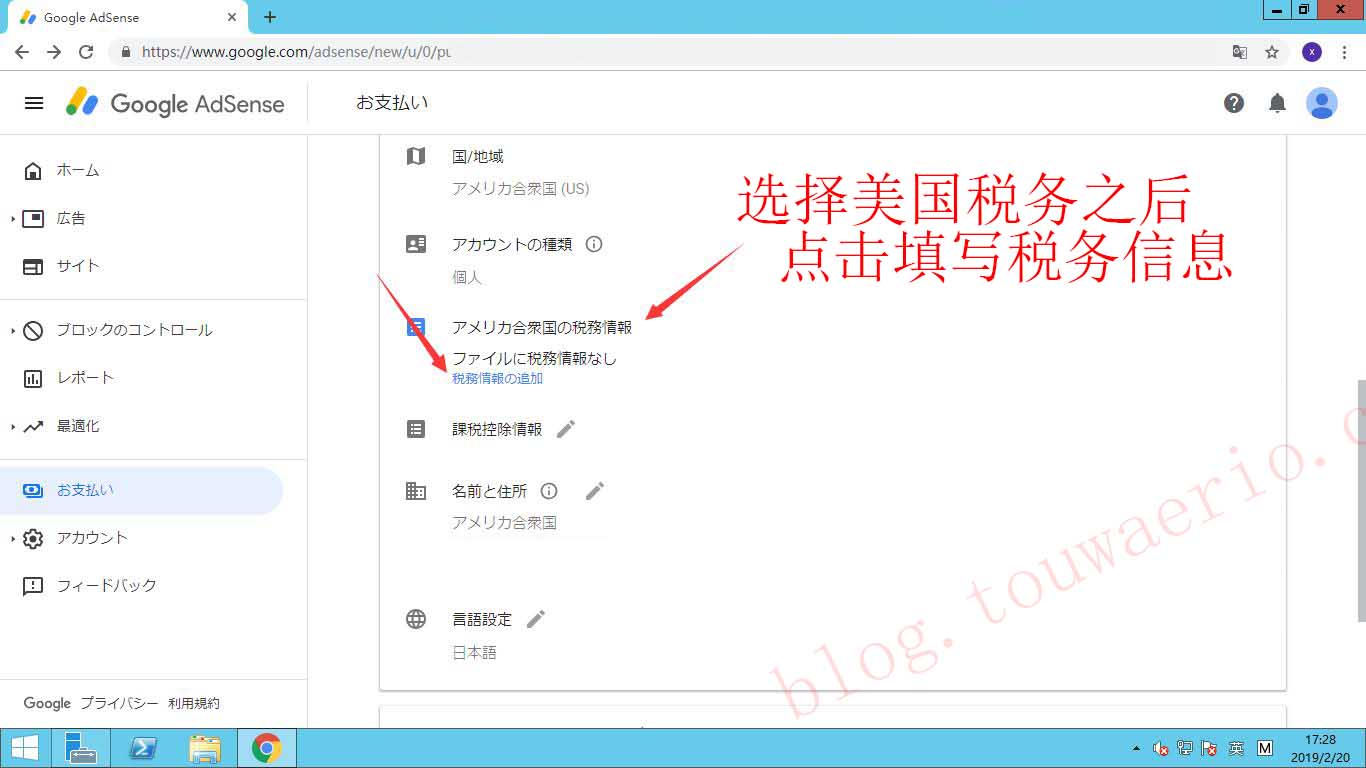

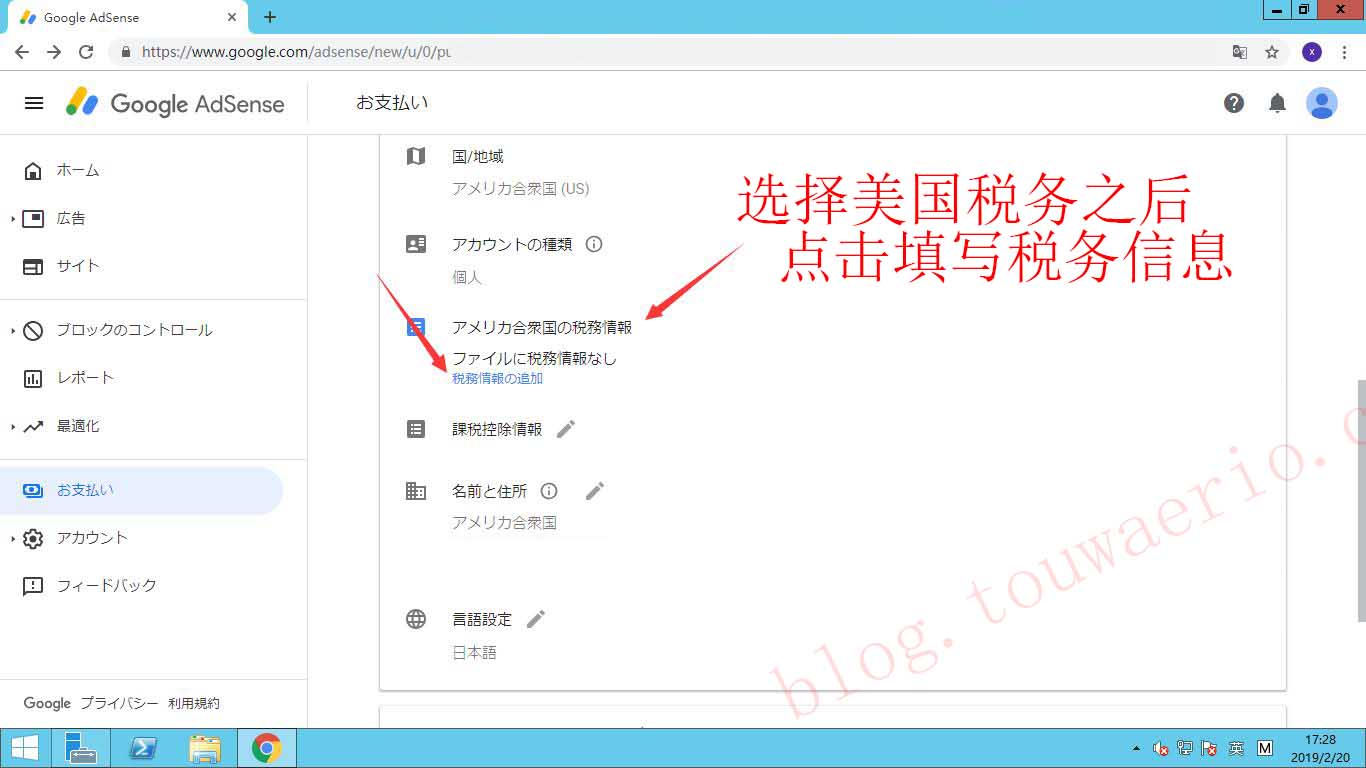

进到个人设置里面之后你可以看到一堆信息你的账号注册国家 以及账号类型 另外还有语言设置 居住地址修改等等,当然这些基础的东西没什么必要讲不过对于买号的人来说或许不知道。

接下来悬着美国税务填写地方他会有一个 笔一样的图标点击之后会出现一个税务信息申报填写的链接 点击即可进入填写税务信息。

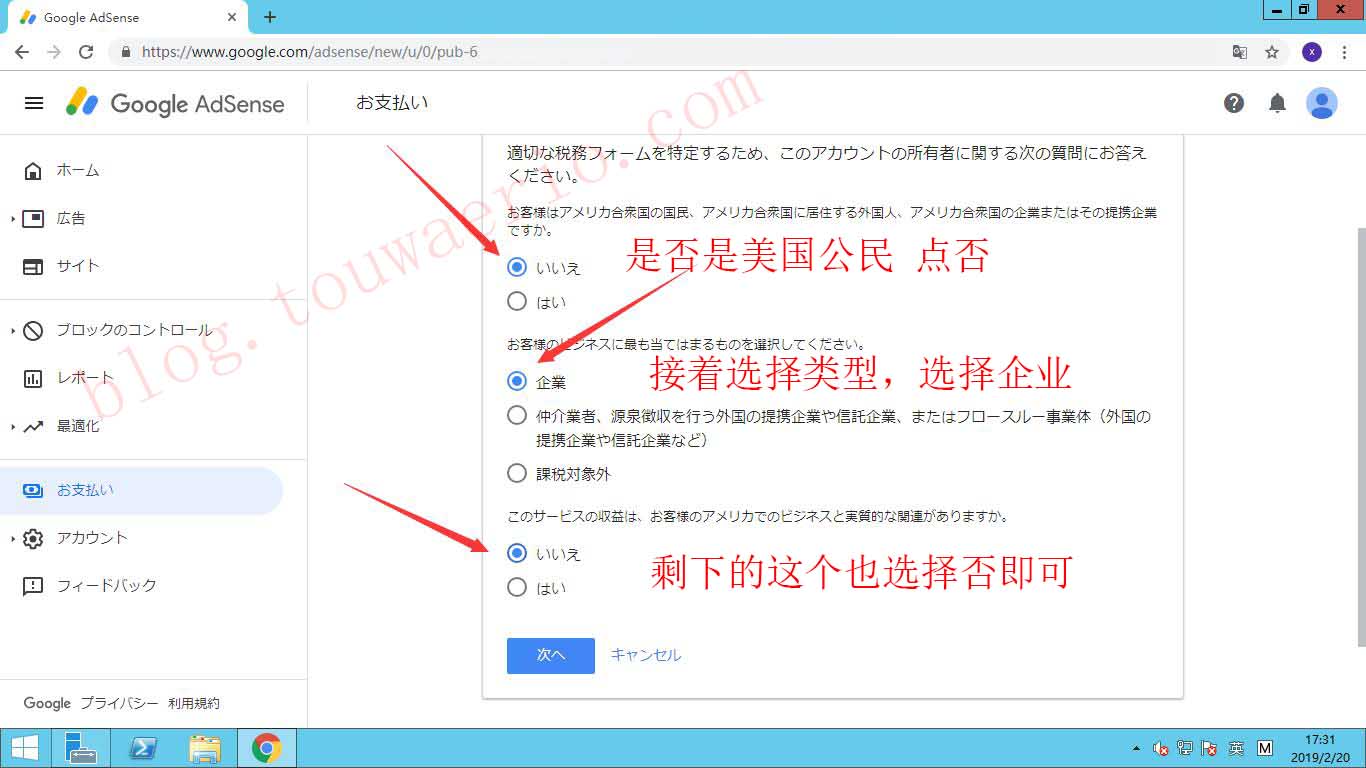

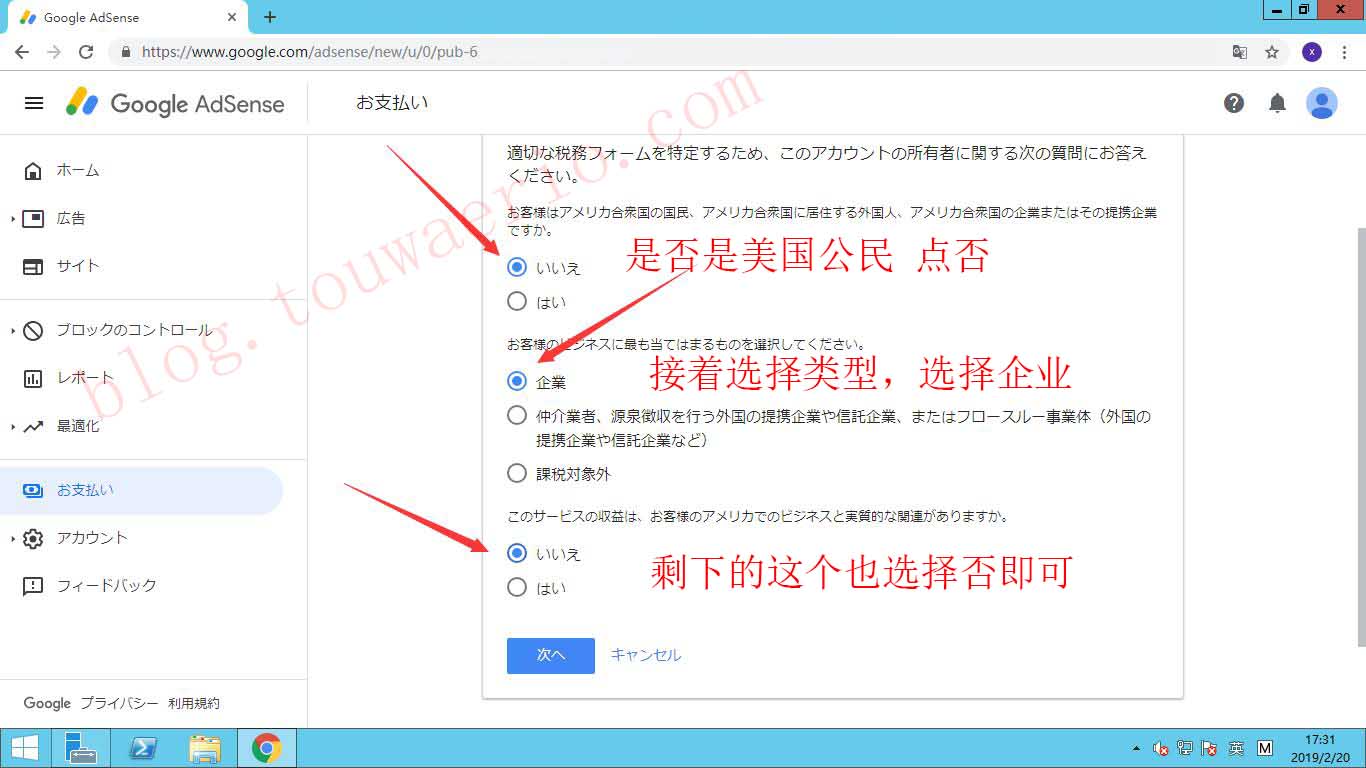

进到税务填信息填写之后就是最基本的选择了,第一个问你是不是美国公民当然你是天朝的很显然不可能去点是这个选项对吧? 然后选择非美国公民之后第二个选项就跟着出现当然 你在其中看不到个人选项于是乎你也不是免税人只能选择企业这个选项了,接下来最后一个选项选择否即可这个可以轻松咯过。

当你填完第一步之后就会进到下一步,这一步才是最麻烦的地方,当然我们选择的是美国以外的居民那么税表就是W-8的 第一步 设置受益者类型(收款人类型)这里你就可以看到个人选项就在其中了这时候就选择上个人即可,接着下一步填写上自己的姓名(注意美国姓名是反的 他们是 名再前姓在后)之后选择你的所在国家你可以理解成你的国籍所在国家什么的 当然你填写美国也可以不过我基本上选择中国,接着就是居住国家这个当然选择美国了。

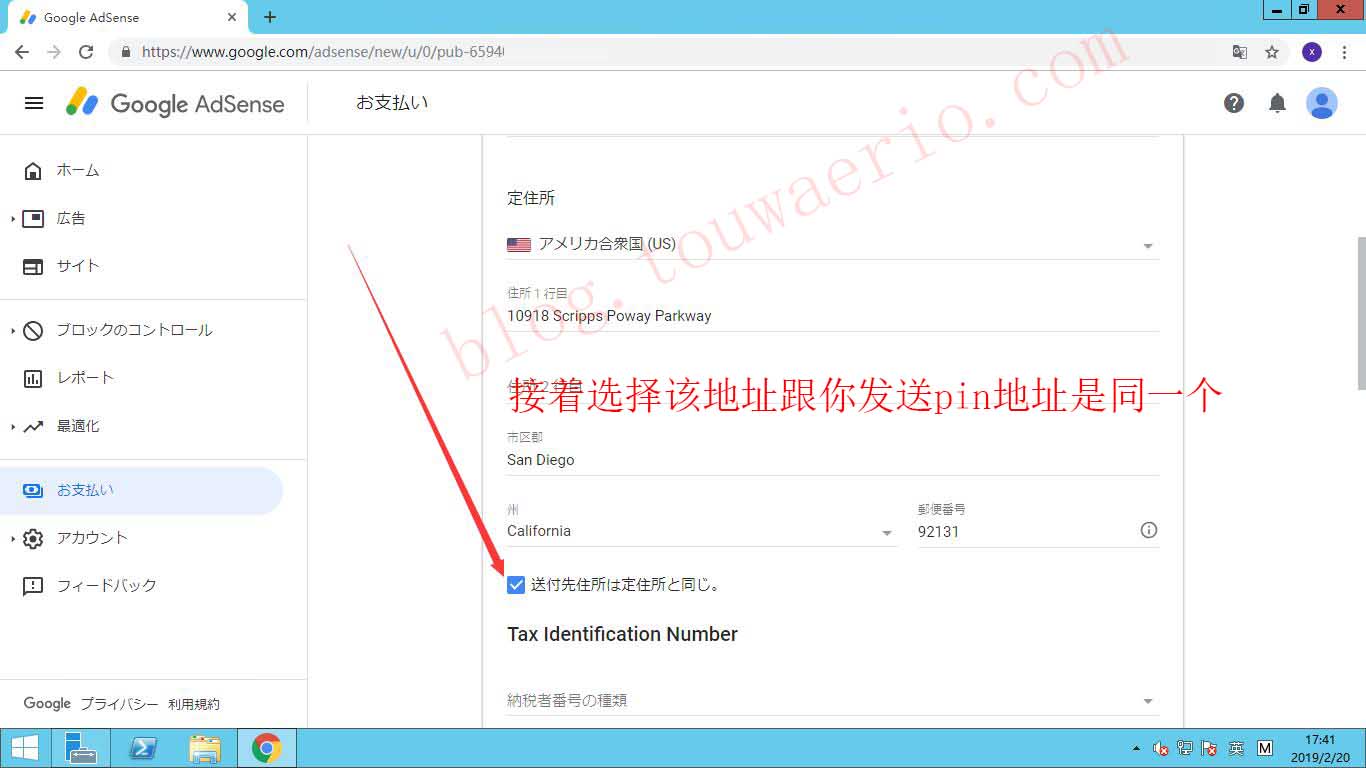

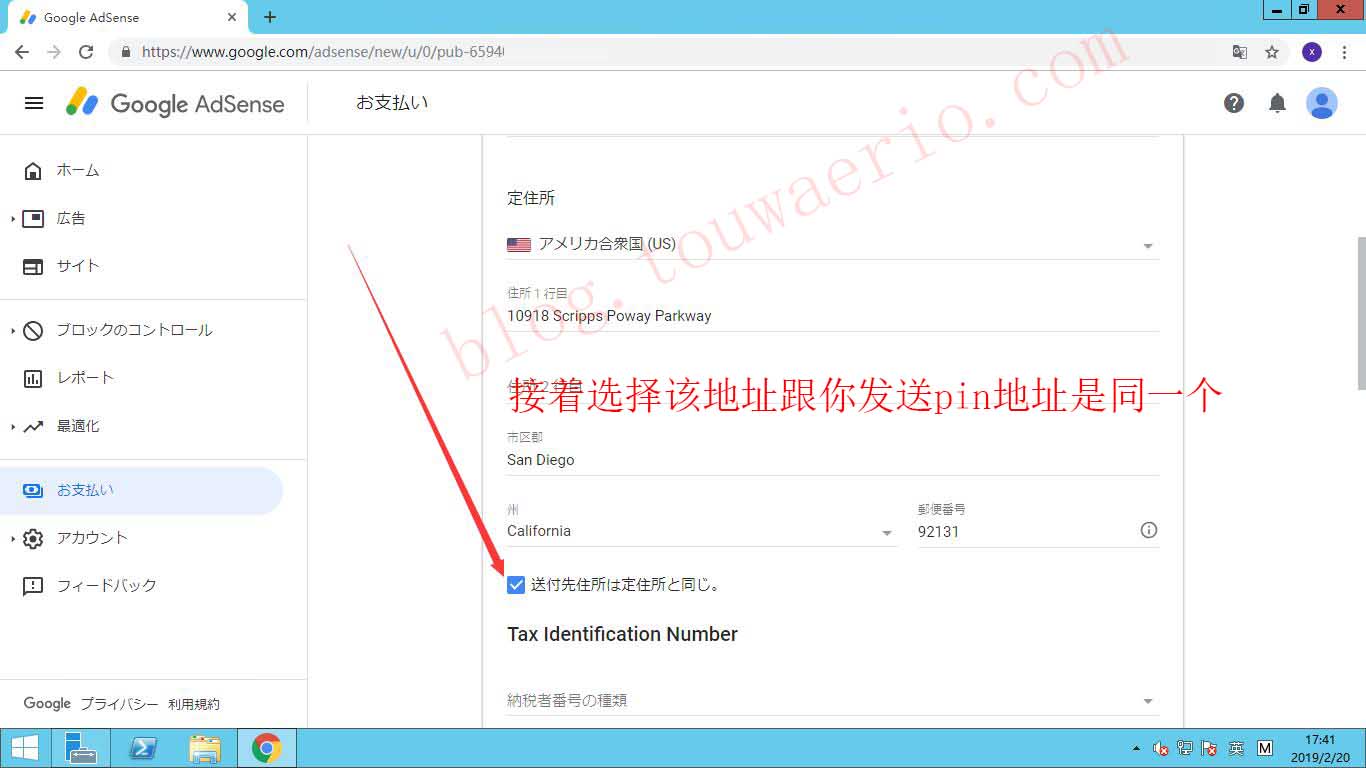

接下来选择玩居住所在国家之后地下会有一个选项该地址是否是你收信件的地址这时候你选上即可当然你也可以在写一个我不写的原因是应为特麻烦不如直接勾上23333 (我这个地址是随便打的并不能收pin哦你填写相同的也没任何用)

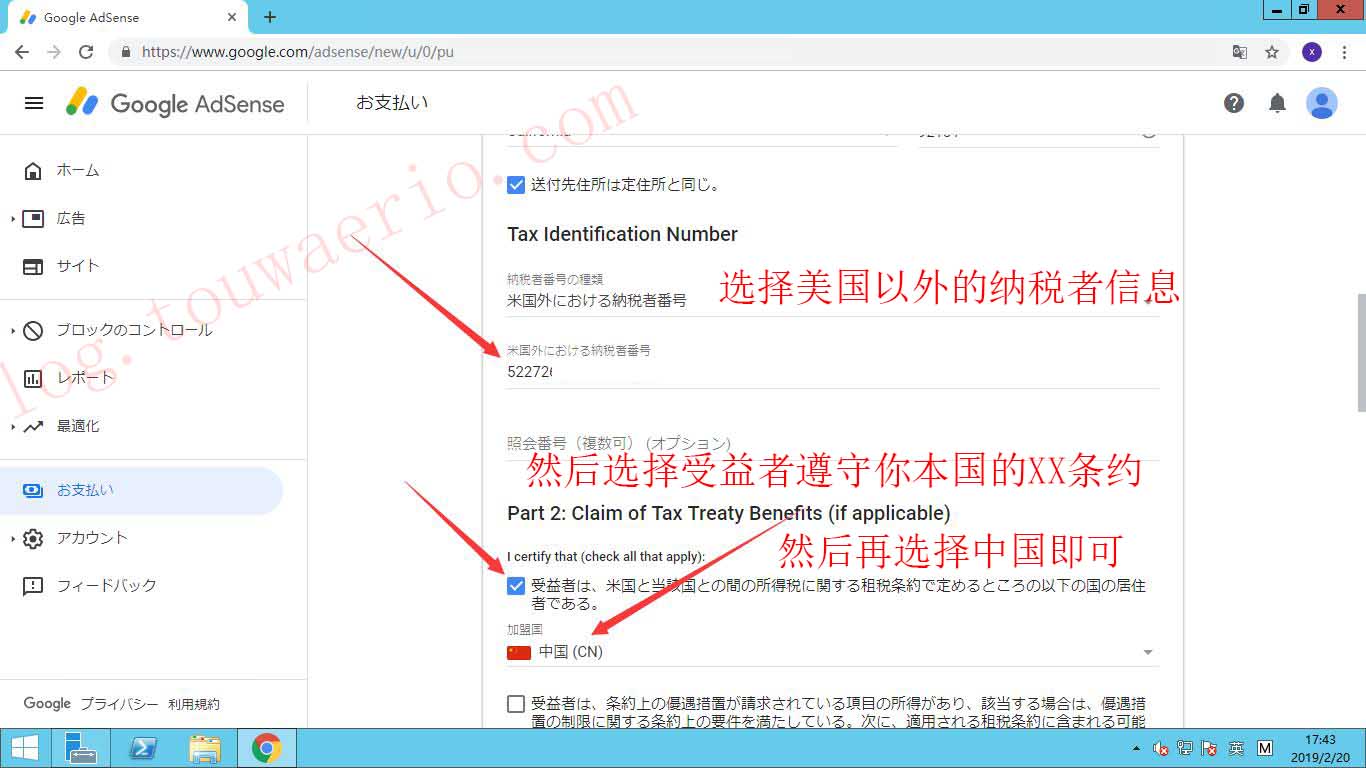

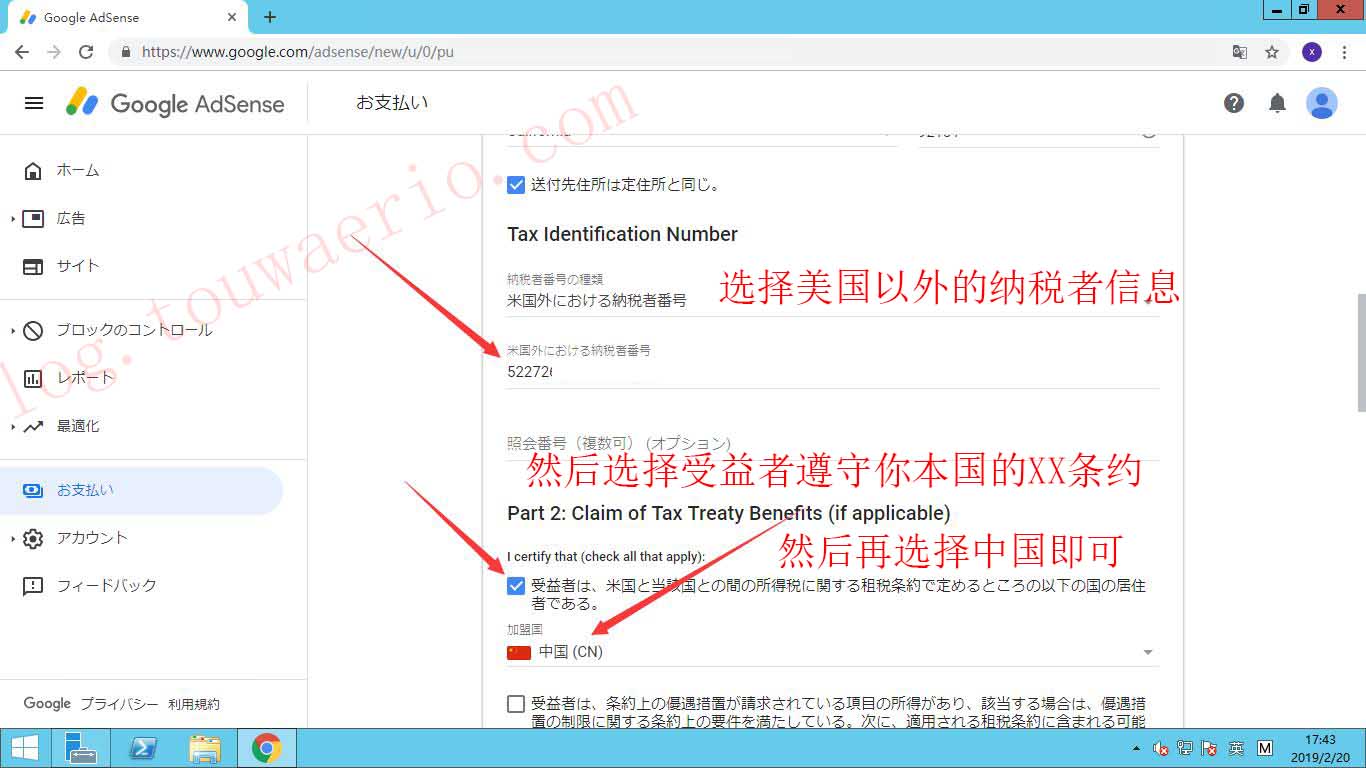

当你完成以上之后会有一个选项这个选项会让你填入SSN信息EIN信息不过你属于国外人没有雇主信息SSN信息你可以选择米国以外的个人信息例如身份证号码,跟你填写的姓名匹配就可以了,目前能不能一个人填写多个税务目前我也还不知道,只知道之前测试的时候2个号同一个人都正常下款了不过我不太推荐这样做。填写完身份证号码之后点击遵守并允许XXX条约 接着条约国家选择中国即可!

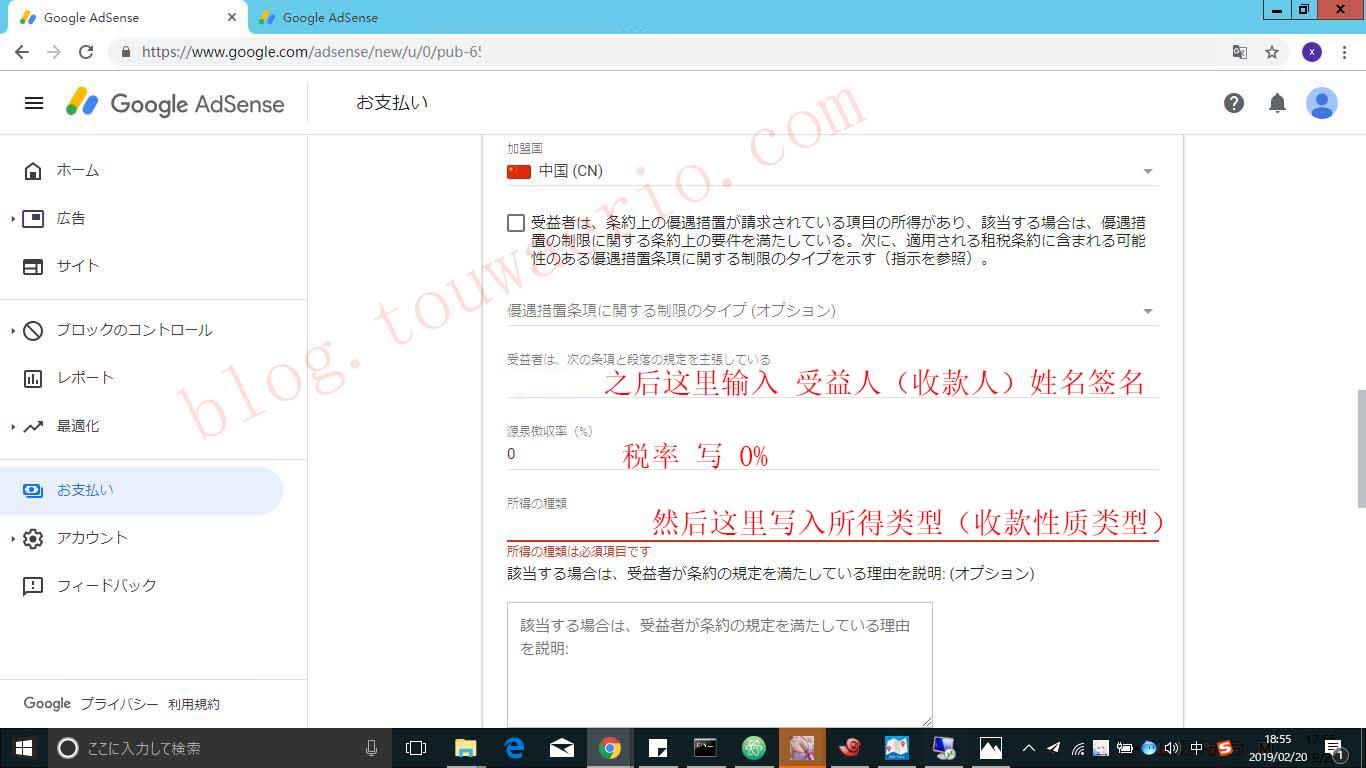

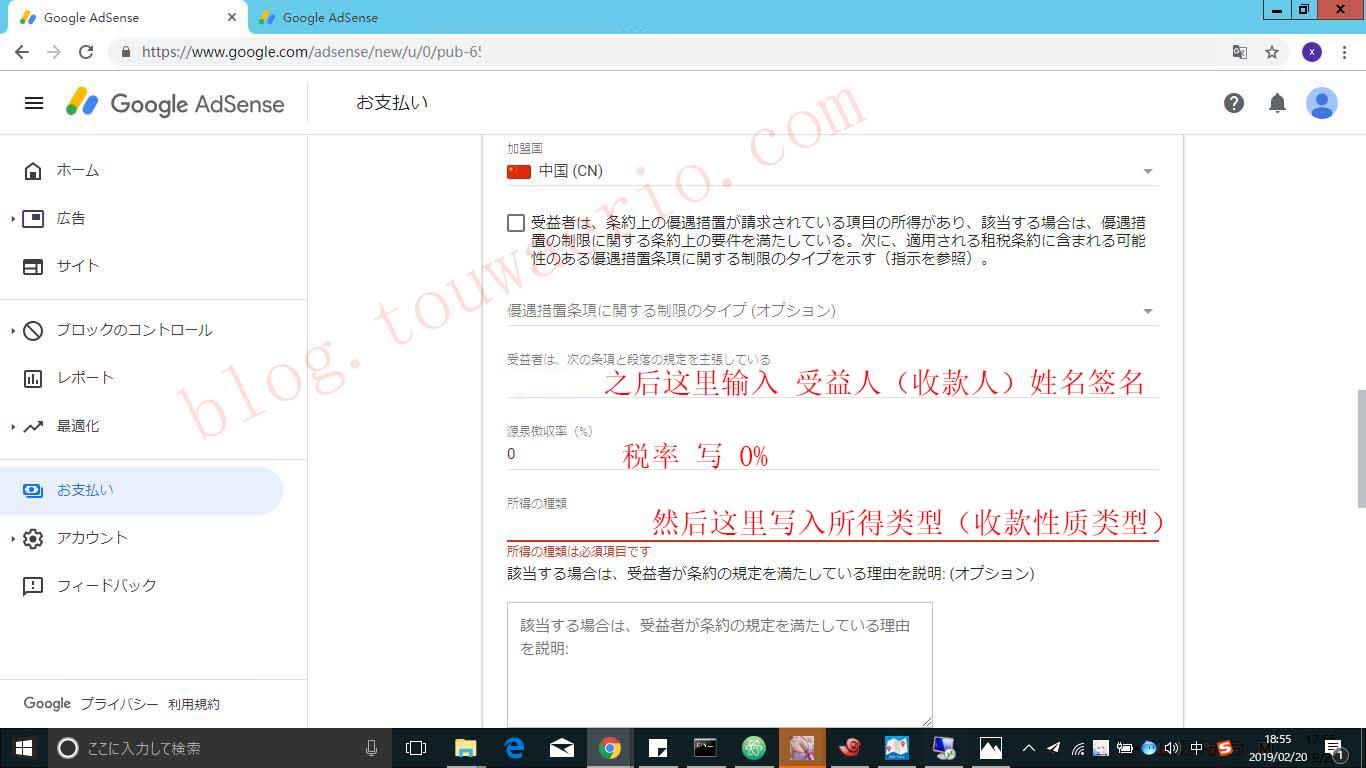

当你完成以上几步之后最后会来到这里以前这三个可以不用填写,但是规则变动之后变成了比填选项,不过也没什么只需要填写上你的个人姓名之后税率填写0%接着最后一个填写上你的收益类型即可完成。

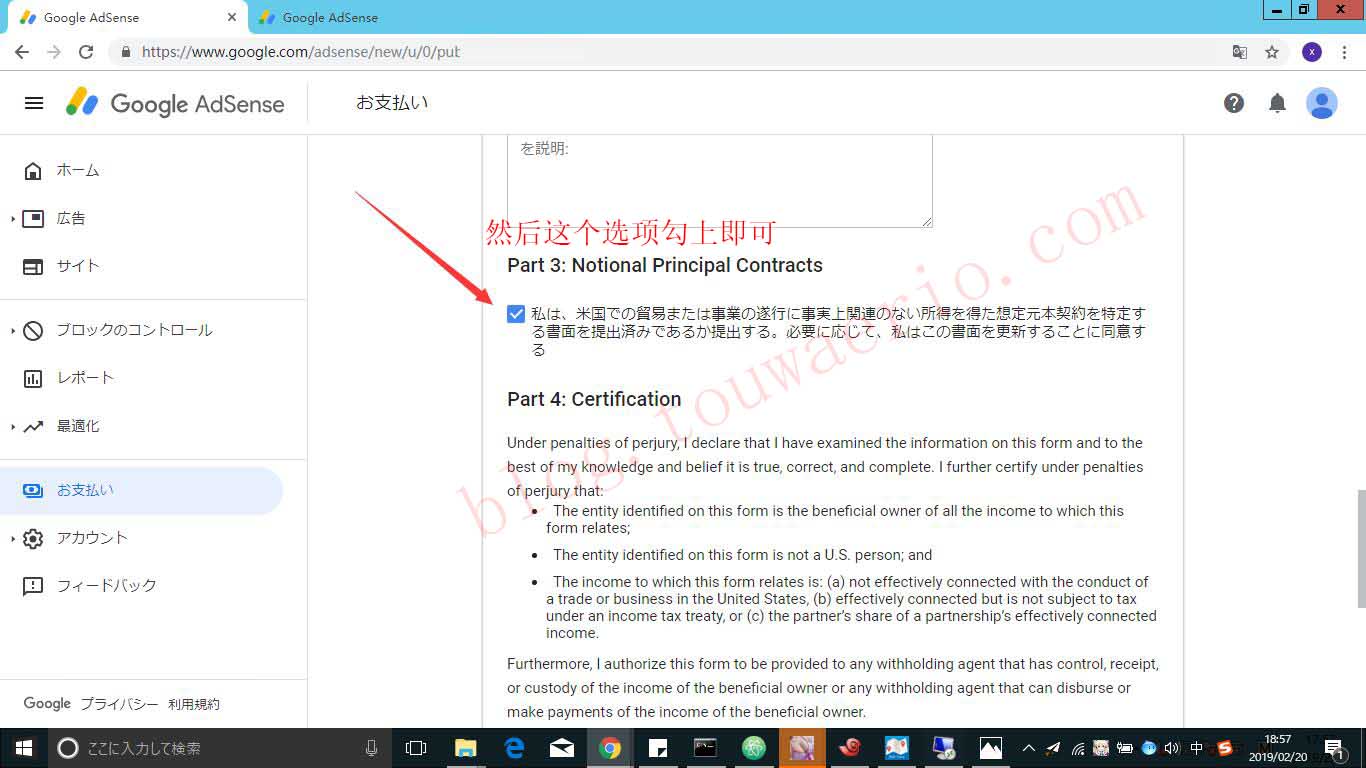

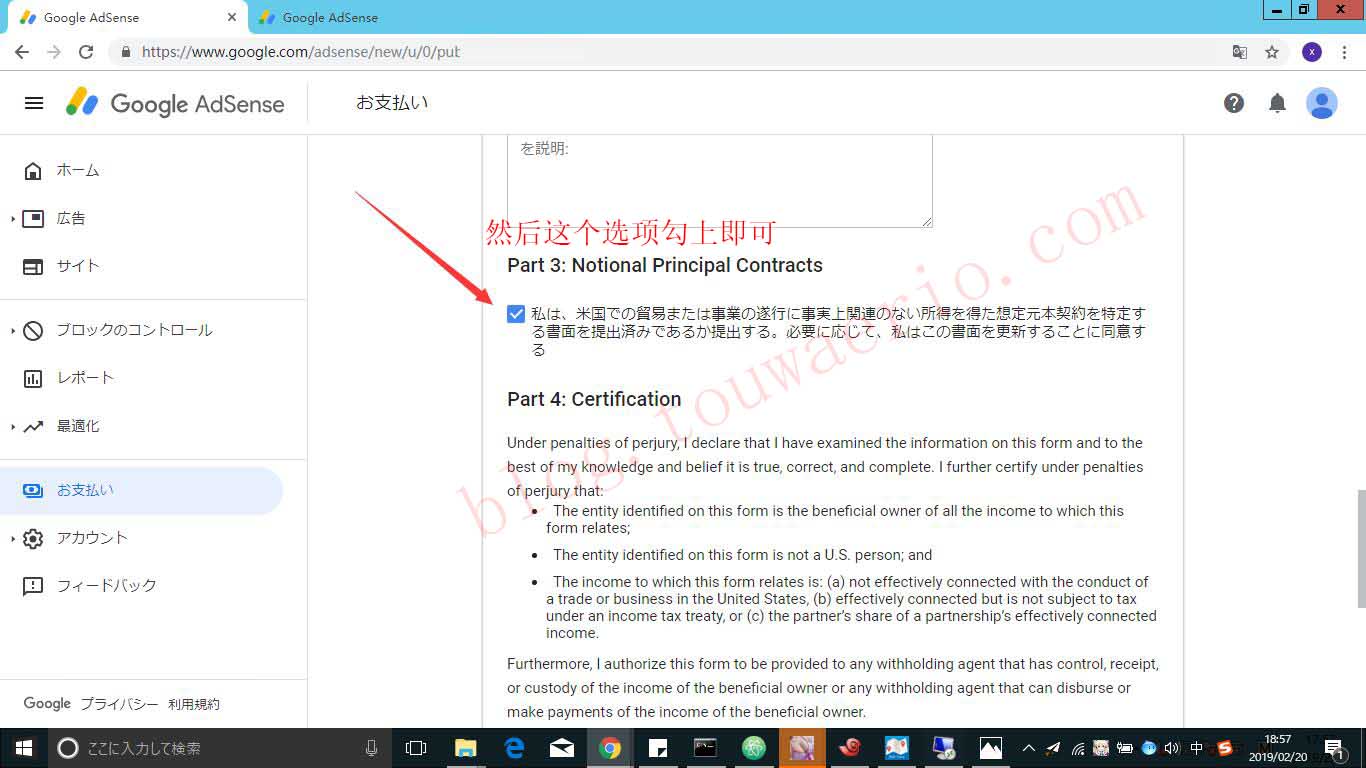

填写完信息之后 Part.3这个地方有个选项请勾上

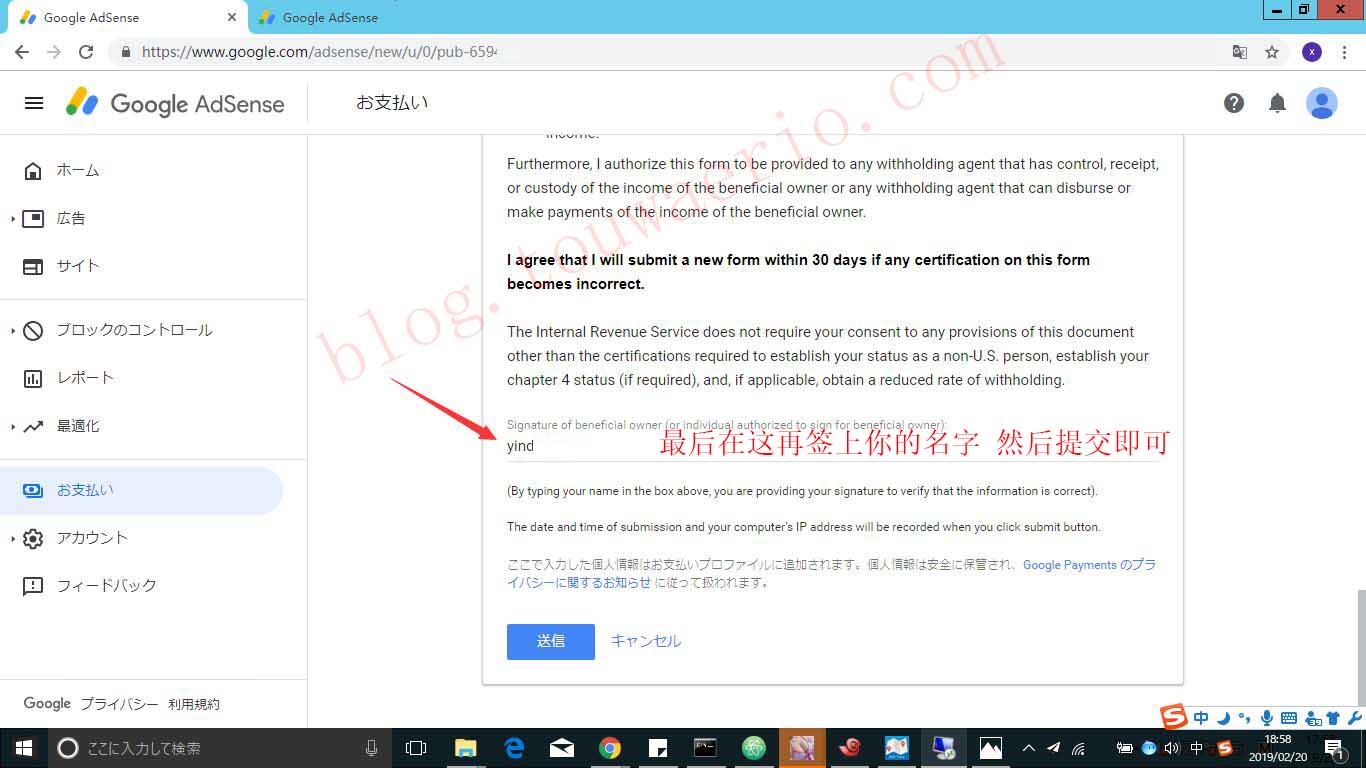

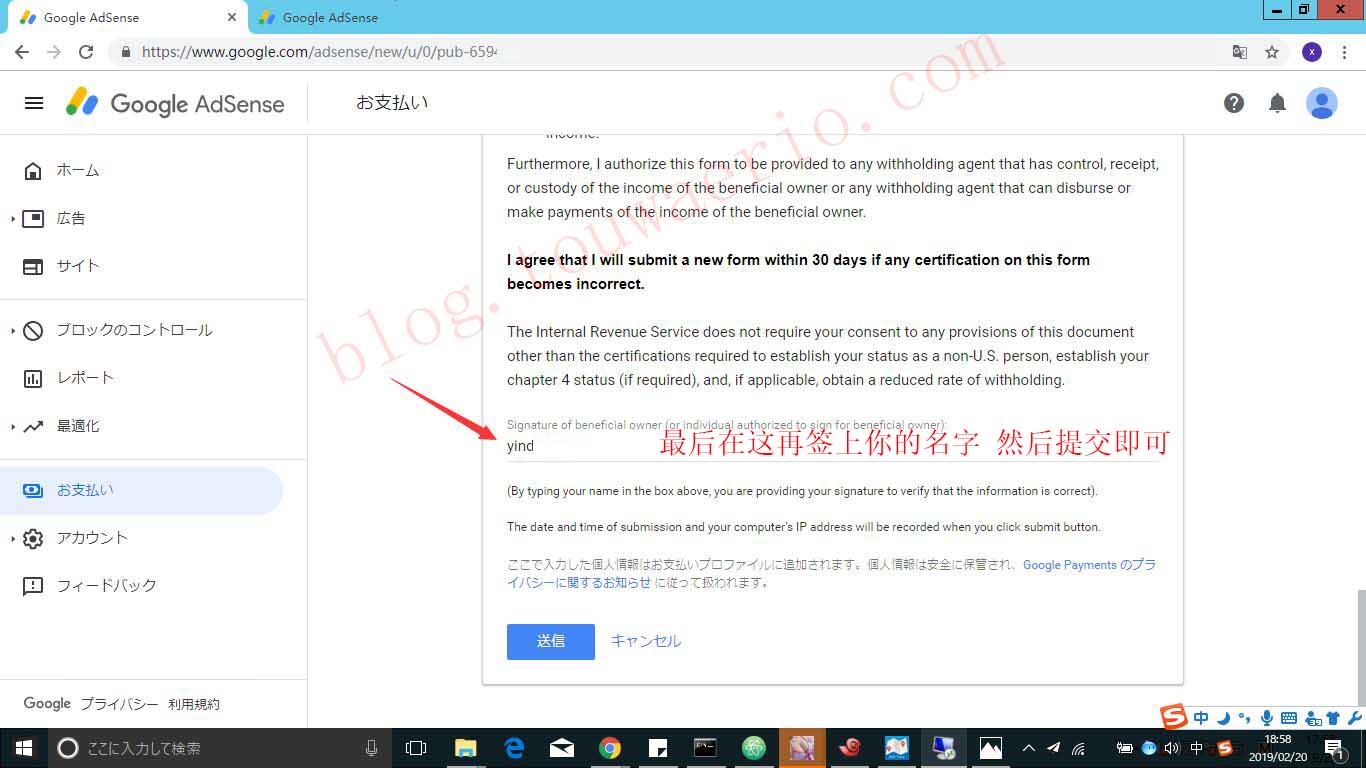

接着最后一步在底下签上你自己的姓名然后提交即可!!!

提交完之后过完pin你就可以正常收款了。另外如果是税务错误等等谷歌发款的时候他会提示你只要稍微就改下哪里不对的信息就可以了!!!!!

那么以上就是简单的Adsense美号W-8税表填写!!!

以上教程部分的内容转载自好友滕滕的博客:Adsense美号税表填写教程

English Reading:

I think the friends who operate the Adsense US account will probably encounter this problem. I recently talked about a company that specializes in collecting money in China. Their family can collect the income of our Adsense US account, which may be a welfare for domestic partners. And the handling fee is only 1%, how to operate it, etc. I will give you a special tutorial.

Because I often register the US number and there are also multiple English websites in operation, I will tell you how to fill out the W-8 tax form for the Adsense US account.

Extended reading:

What is the US W8 W9 Tax Certification Form? How to fill in?

Adsense US Tax Filling Tutorial

First of all, of course, the first point is that you need to have an American Adsense account, otherwise there is no use for it! Of course you still need to prepare the information.

Personal identification card x1

- US address x1

- The United States can help you collect the pin

The above is what you need. Once you are complete, you can fill in the Adsense US tax! Of course, you can fill in the pin first and then collect it.

You may be interested:

New blog quick application for Google AdSense account approved skills and Q&A

Google Adsense related application optimization collection tutorial topic finishing

Web site free management automatic profit sharing skills - hello dirty case

Building an English website to earn Google Adsense dollars (long text)

first step

Log in to the Adsese backend and open the payment information option to set it up. My system is Japanese. So the account registered by Google is basically following the general tax filling of my system. It is the process that everyone can watch! !

Then see the setting place there is a user information display, then click on the settings management to enter the personal settings, of course, the personal settings are your registered user information. Of course, the pin to modify the address is also modified from here.

After entering the personal settings, you can see a bunch of information, your account registration country and account type, as well as language settings, residence address modification, etc. Of course, these basic things are not necessary, but for those who buy the number, perhaps not know.

Next, the US tax is filled in. He will have a pen-like icon. After clicking, a tax information report will be displayed. Click to enter the tax information.

After entering the tax filling information, it is the most basic choice. The first one asks if you are a US citizen. Of course, you are a celestial person. It is obviously impossible to go to this option. Right? Then choose the non-US citizen and the second option will follow. Of course you can't see the personal option in it. So you are not the tax-exempt person can only choose the enterprise option. Then the last option can be selected. Over.

When you fill in the first step, you will move on to the next step. This step is the most troublesome place. Of course, we choose residents outside the United States. The tax form is the first step in setting the beneficiary type of W-8. Type of money) Here you can see that the personal option is in it. You can choose the person at this time, and then fill in your name in the next step (note that the US name is negative, they are the name and the last name is after) Choosing your country can be understood as the country of your nationality. Of course, you can fill in the United States. But I basically choose China, and then I live in the country. Of course I choose the United States.

Next, after choosing to play in the country where you live, there will be an option in the underground. Is the address the address you received? At this time, you can choose it. Of course, you can also write one. I don’t write it because it should be a special trouble. 23333 (My address is free to play and can't receive pin. You can't use the same )

When you finish the above, there will be an option. This option will let you fill in the SSN information EIN information. However, if you belong to a foreigner, there is no employer information. You can choose personal information other than the country, such as an ID card number, to match the name you filled in. Yes, I can't fill in multiple taxes at the moment. I don't know at the moment. I only know that the same person in the previous test is the same as the other one, but I don't recommend it. After completing the ID number, click to comply with and allow the XXX treaty. Then the treaty countries choose China!

When you finish the above steps, you will come here last. These three can be filled out, but the rules change to become more than the options, but there is nothing to fill in your personal name and the tax rate is 0% and then the last one. Fill in your income type to complete.

After filling out the information, there is an option in the place of Part.3.

Then the last step is to sign your own name and submit it! ! !

After the completion of the submission, you will be able to collect the money normally. In addition, if it is a tax error, etc., when Google sends money, he will prompt you to change the wrong information if you change it slightly! ! ! ! !

Then the above is the simple Adsense US W-8 tax form to fill out! ! !

The content of the above tutorial is reproduced from the blog of my friend Teng Teng: Adsense US Tax Form Filling Tutorial

特别优惠:免费赠送 $50 Vultr主机-限时优惠!Adsense英文站必备海外服务器!点击了解更多

100%的隐私,我和你一样讨厌垃圾邮件!

能不能让海外 比如用澳洲的另一个亲友收款呢 写他的信息收不知道是否可行?

@Robinico 同地区可以使用另外的人收款

不知道博主是怎么收款的,我最近刚达到100美金,跑了几趟银行都不给办理

@Franco 国内号现在只有固定的几个城市可以收